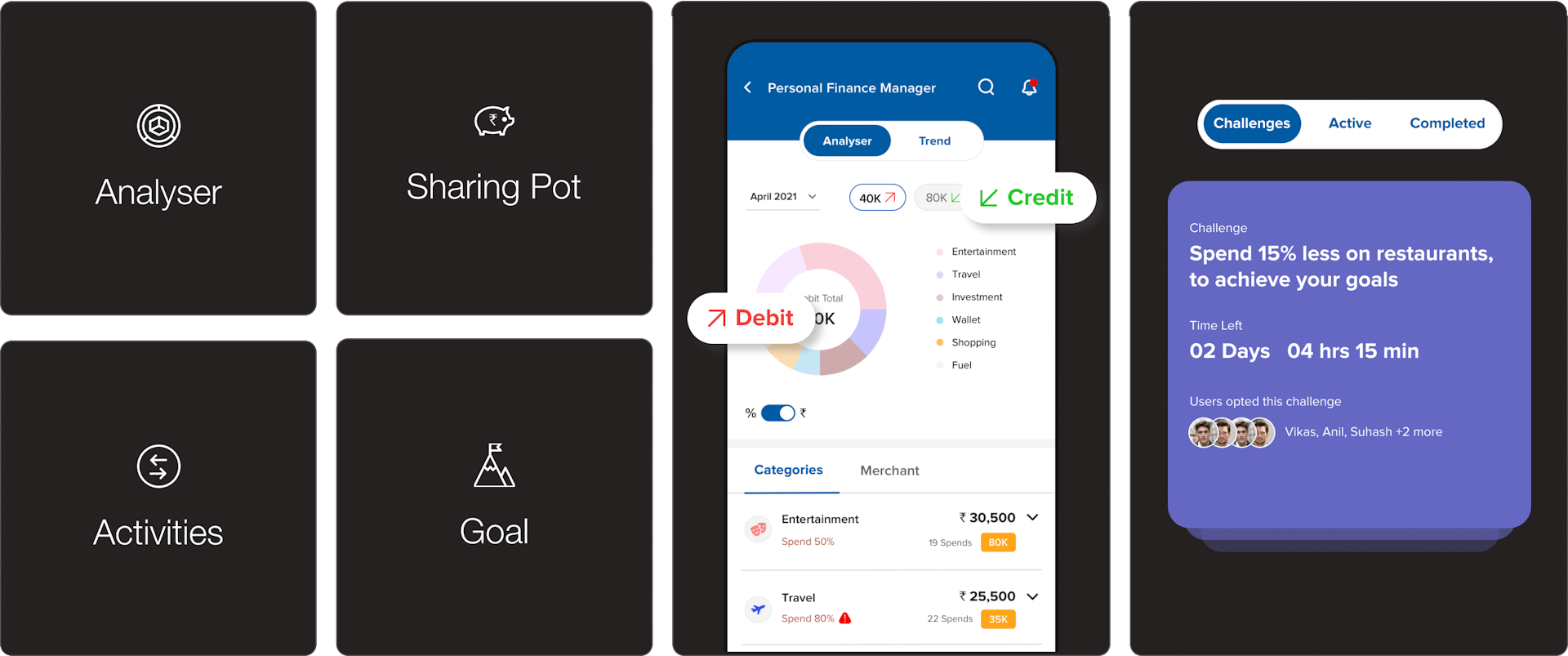

A UI/UX Case Study on “Personal Finance Management”

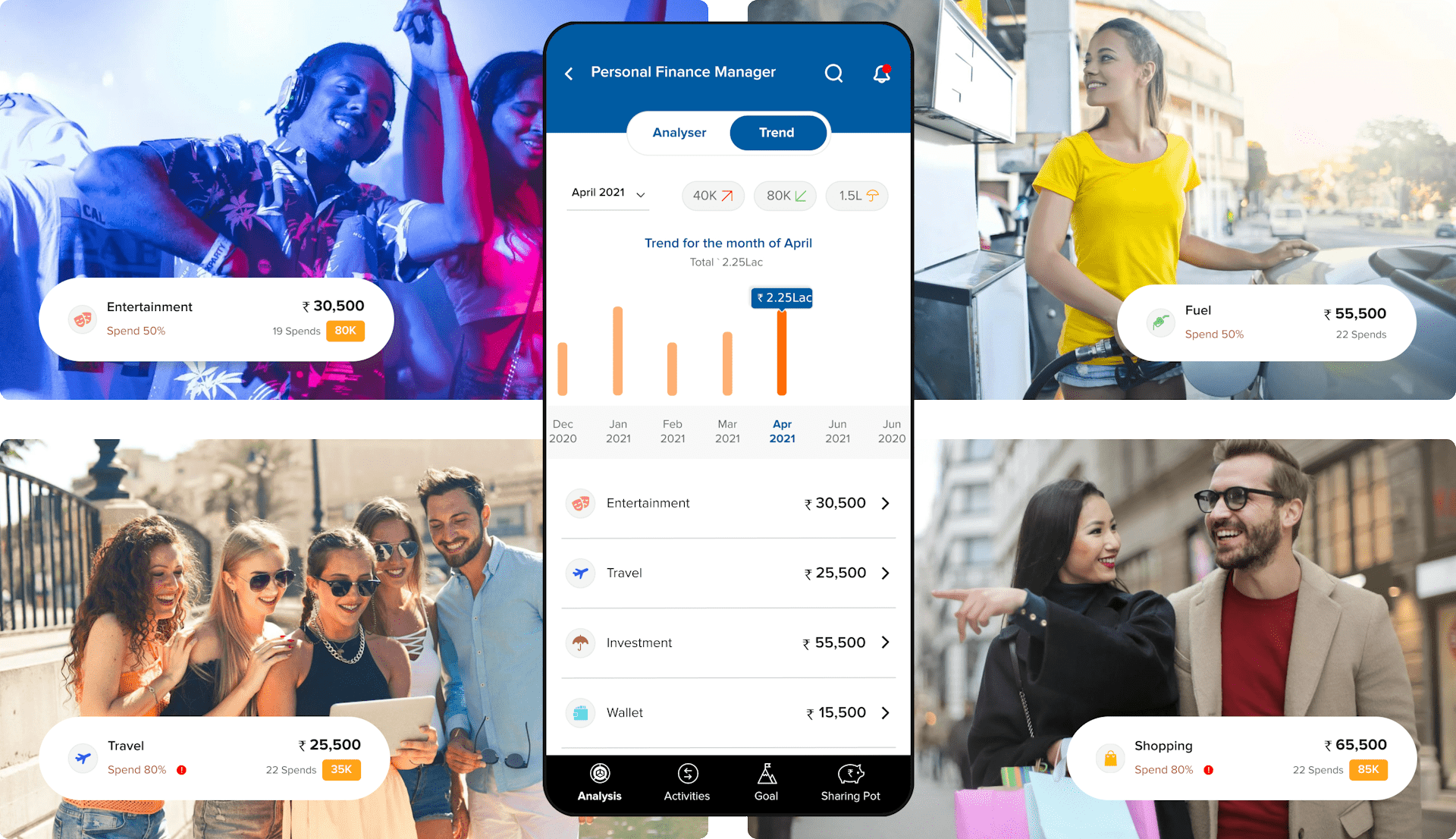

Our user-friendly finance app simplifies money management, guiding informed decisions for lasting financial success. Effortlessly track, optimize, and achieve your goals while fostering financial awareness and savings habits. Join us on your journey to financial stability and resilience.

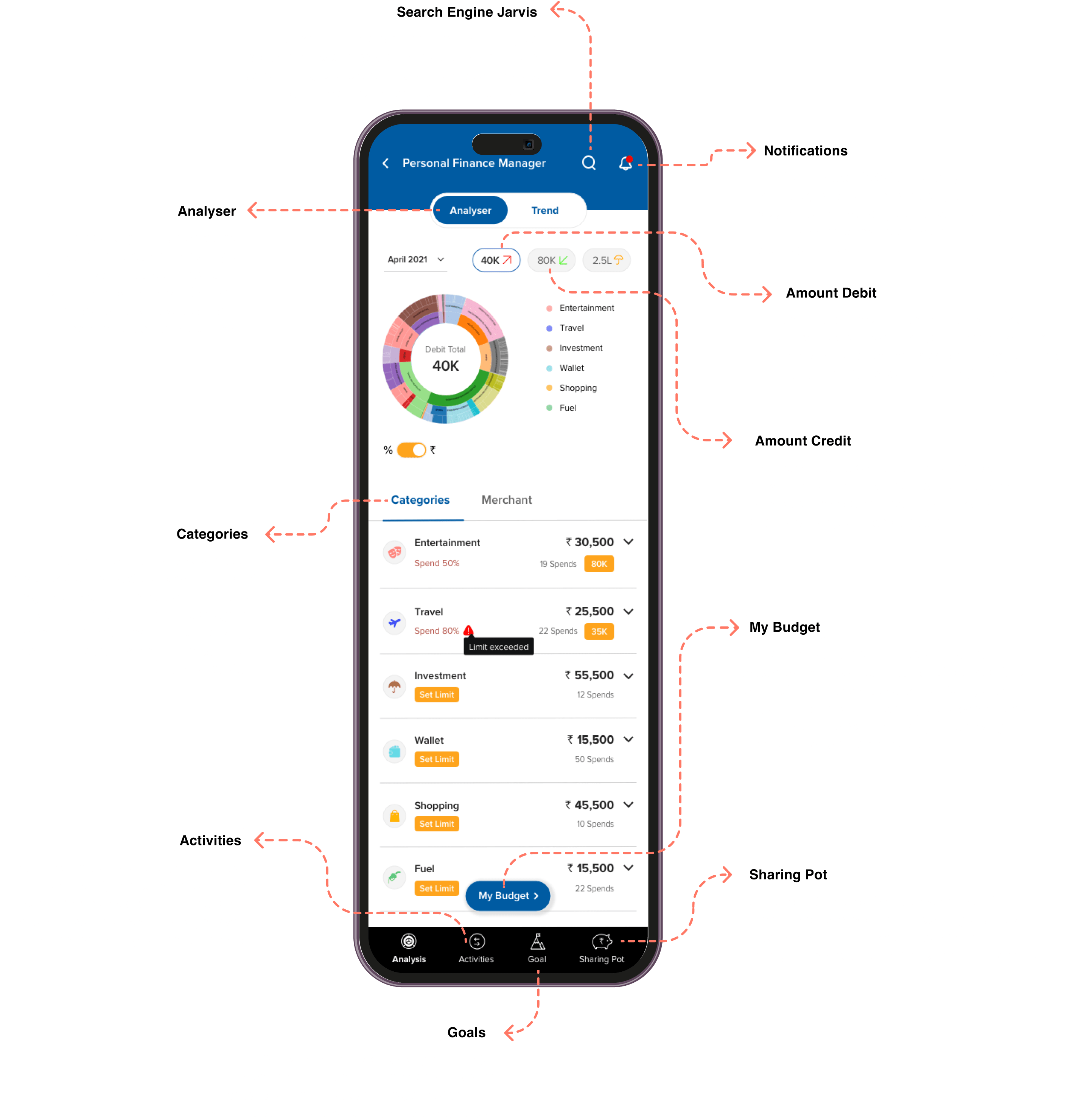

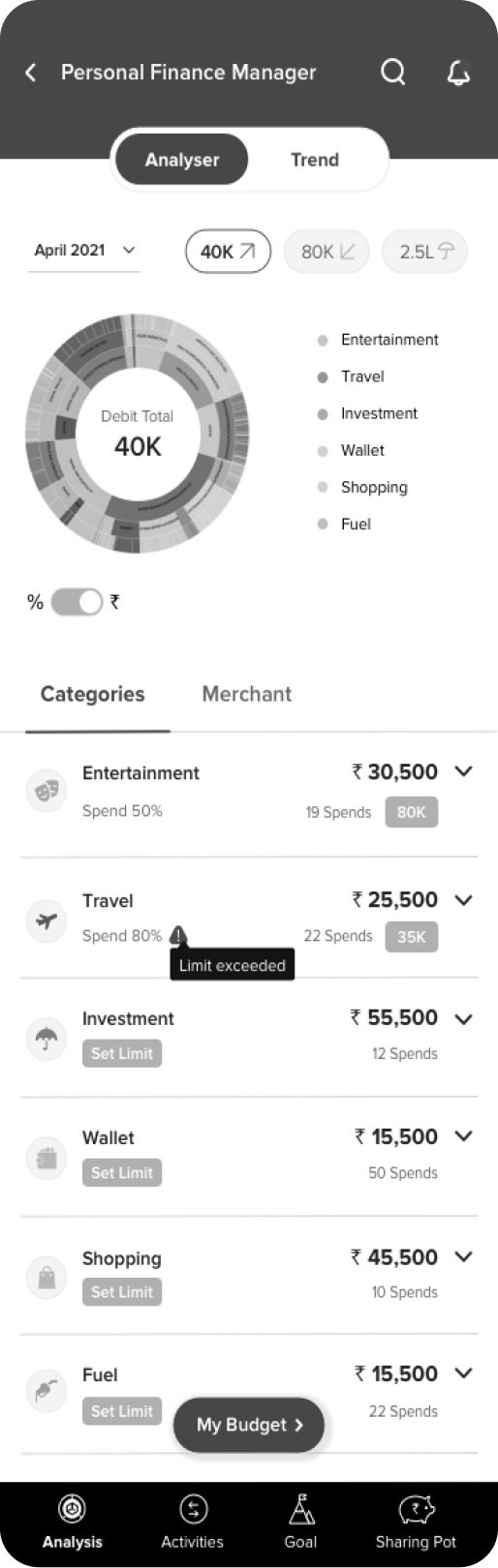

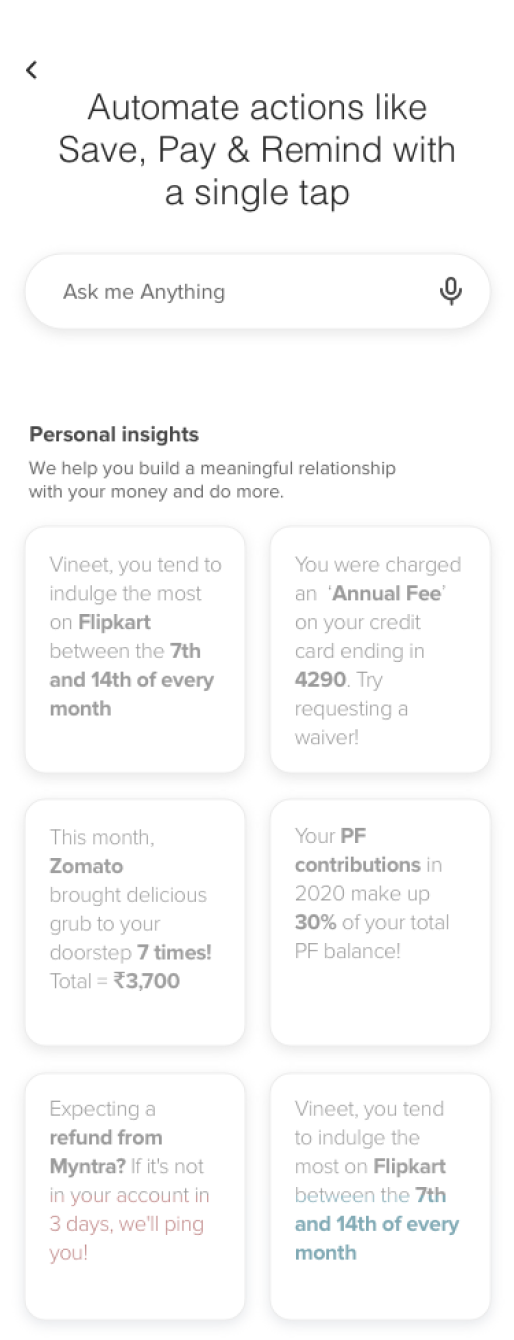

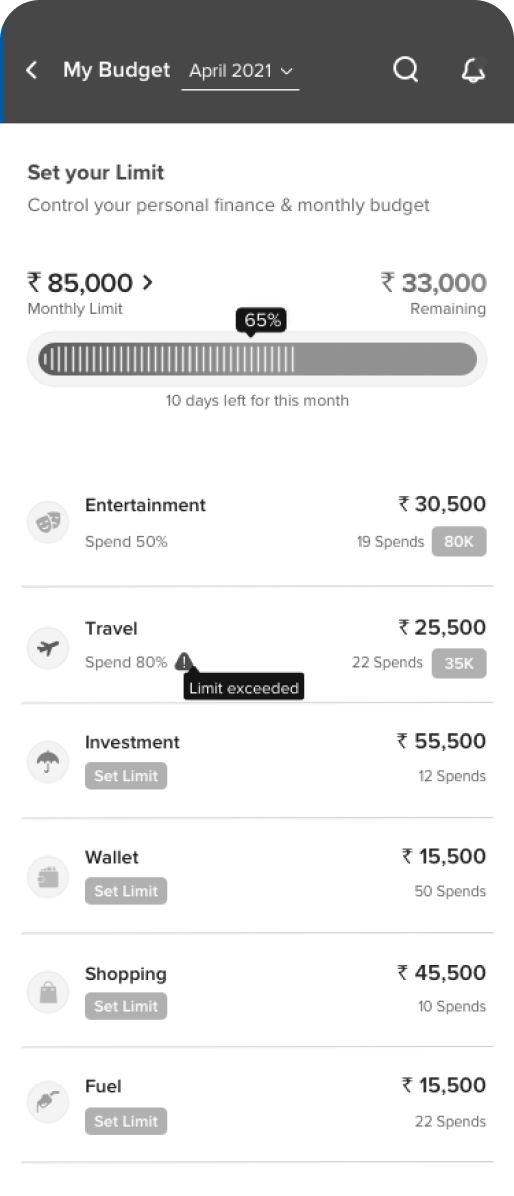

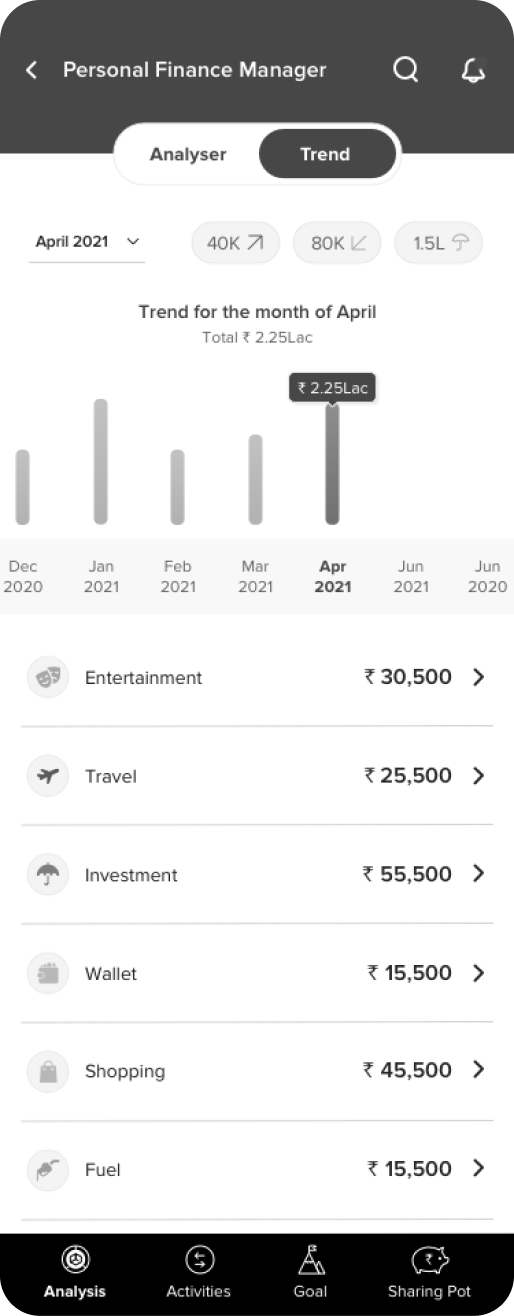

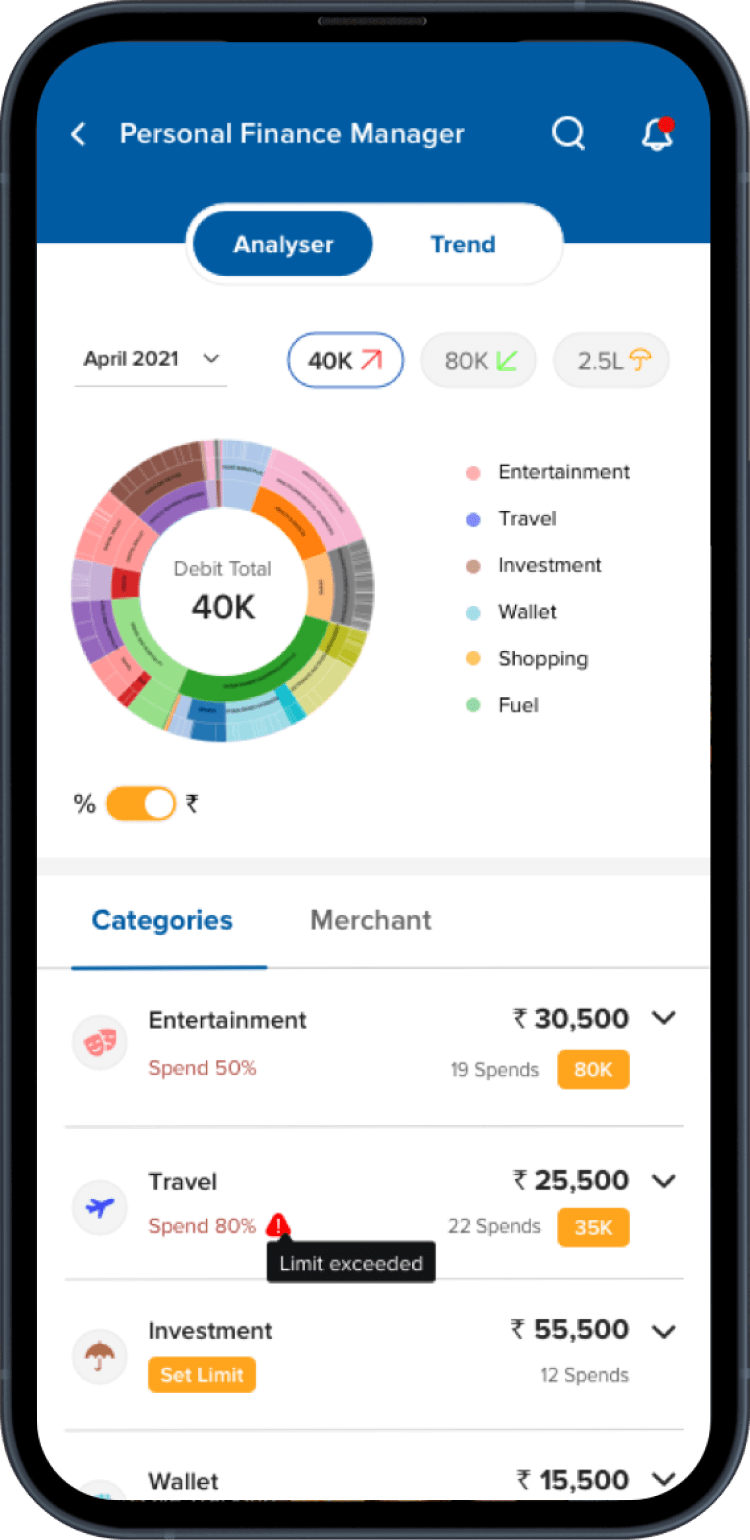

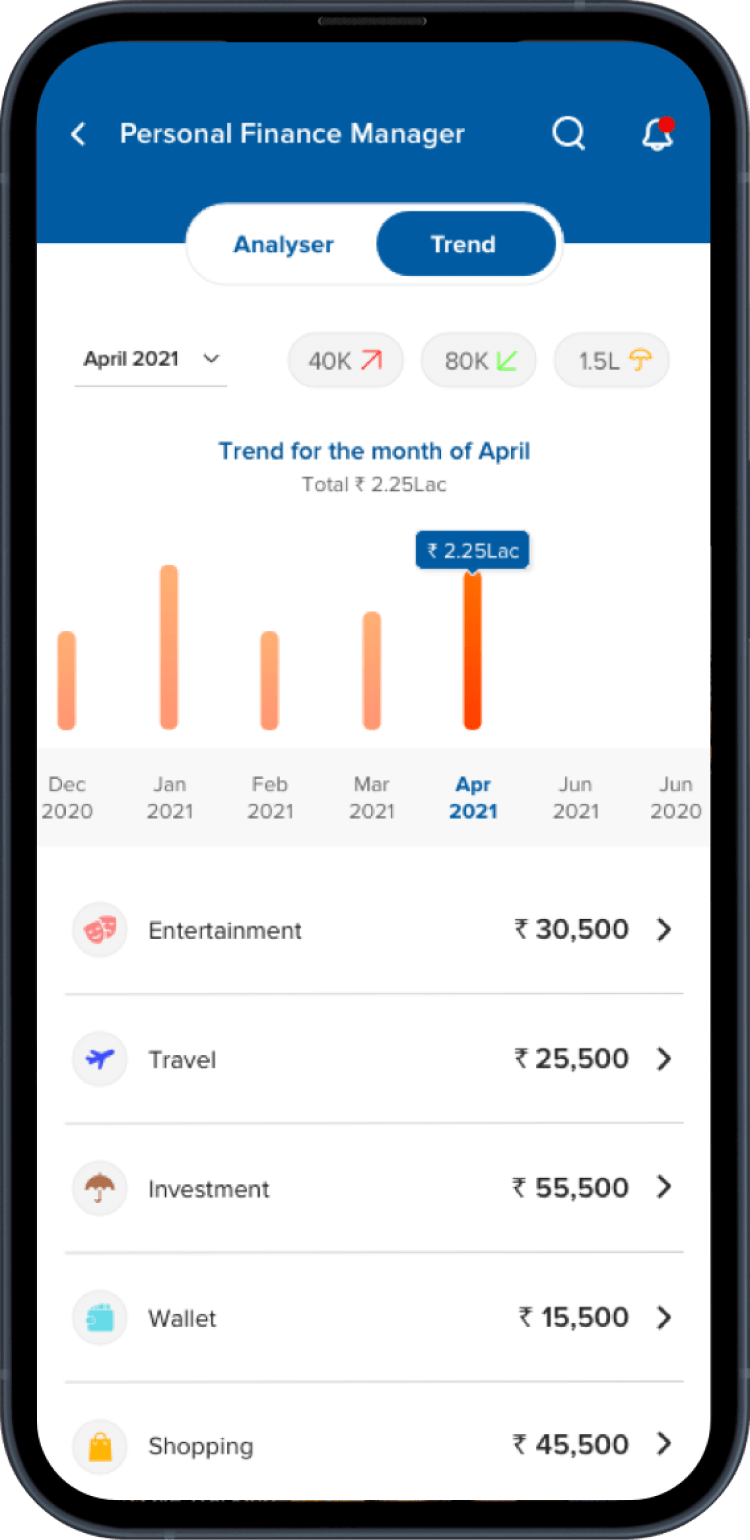

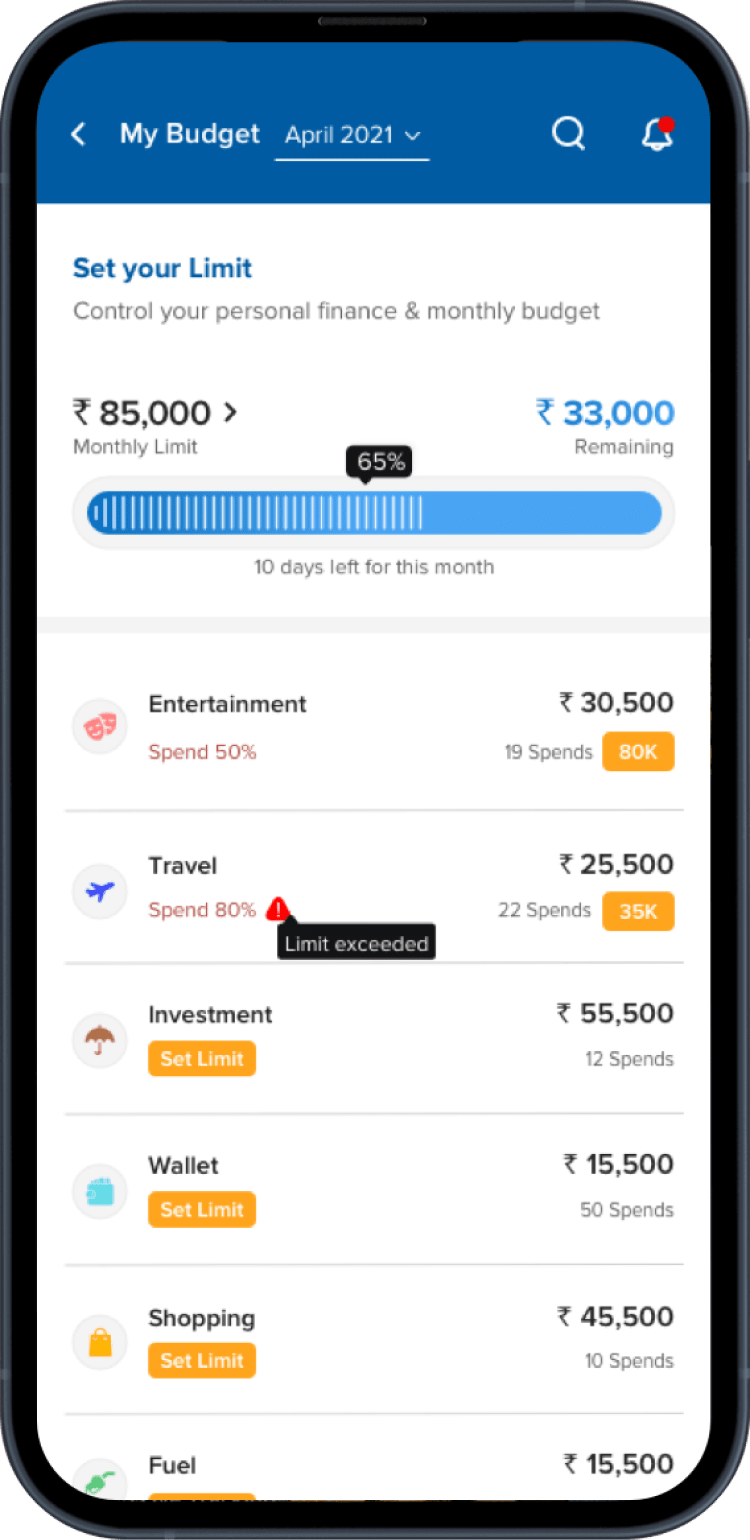

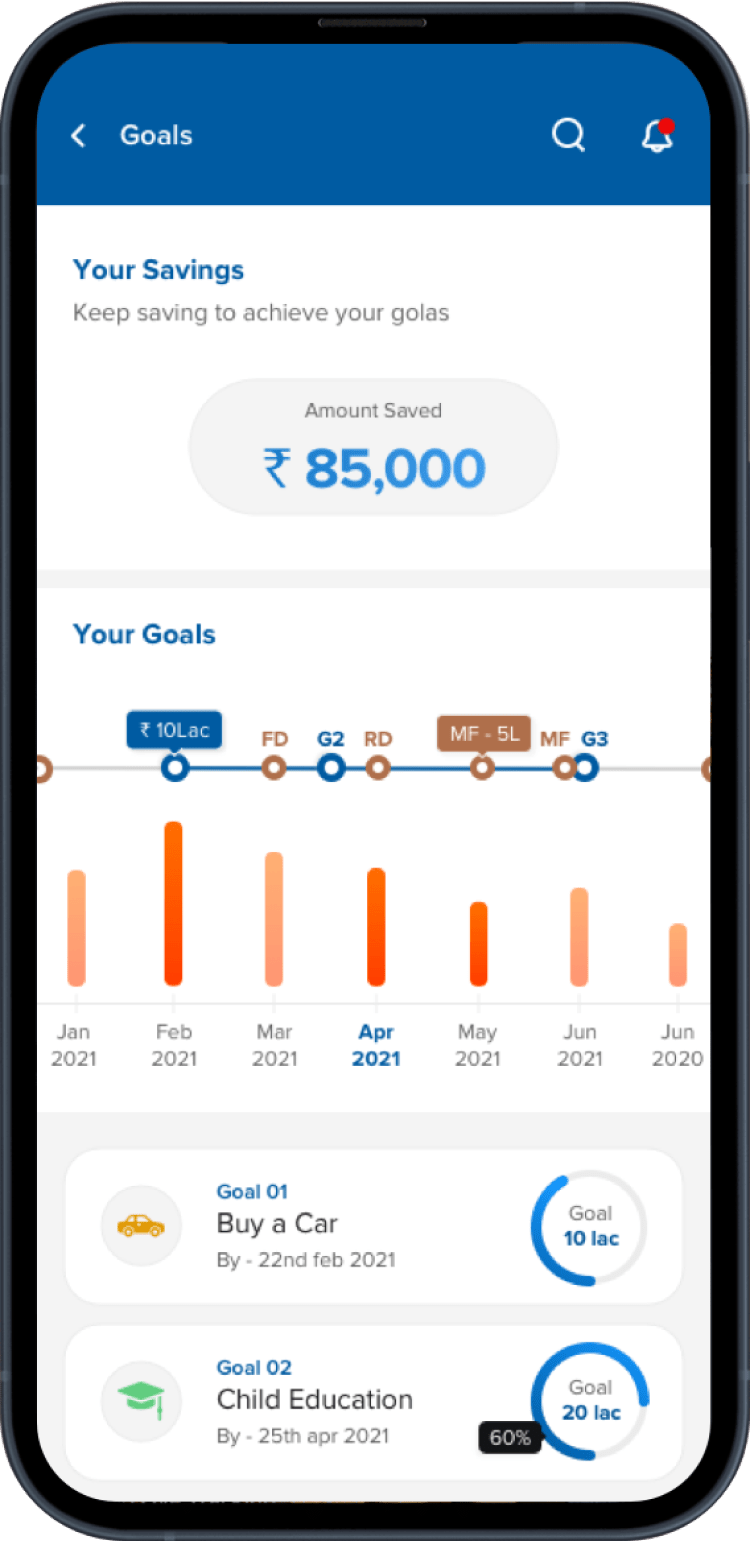

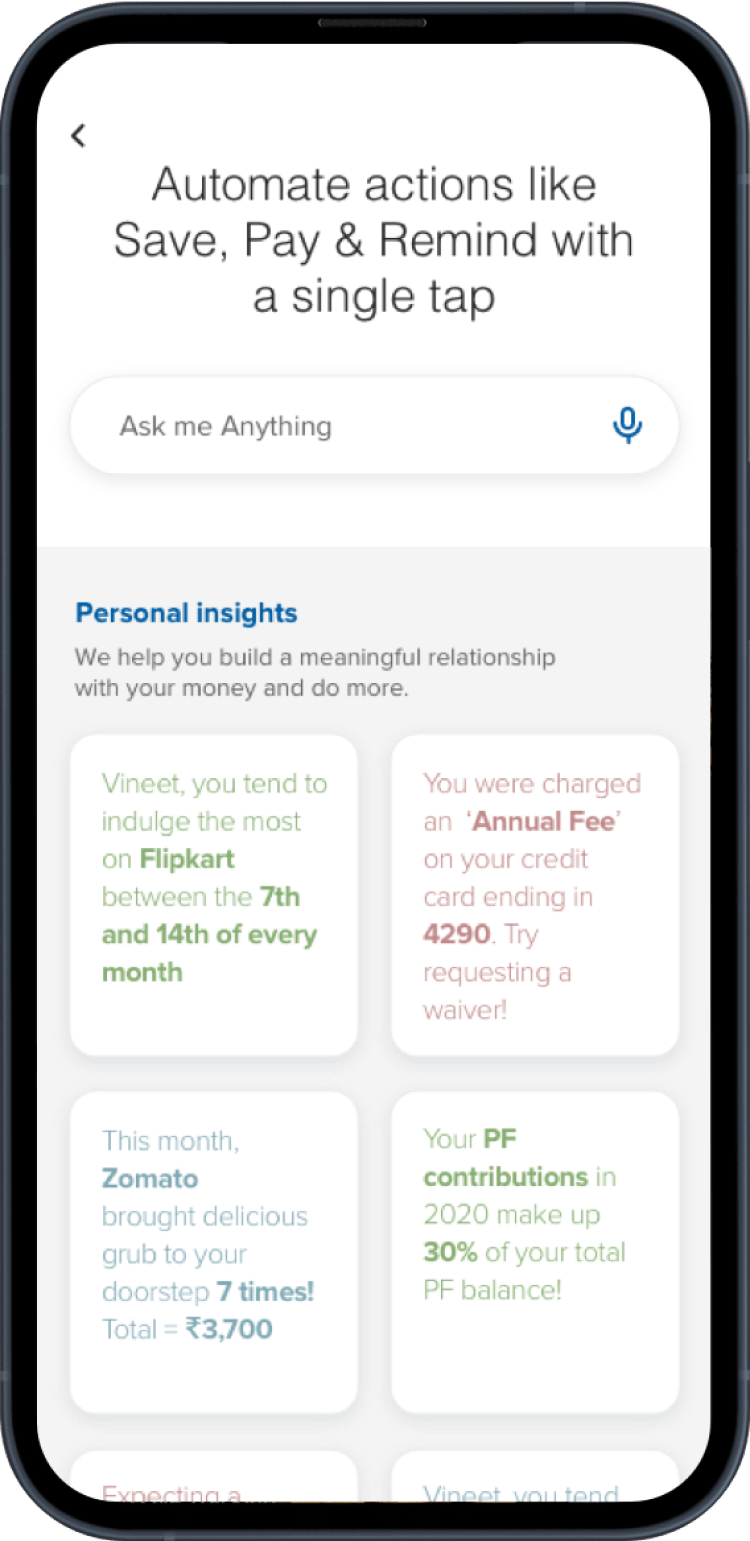

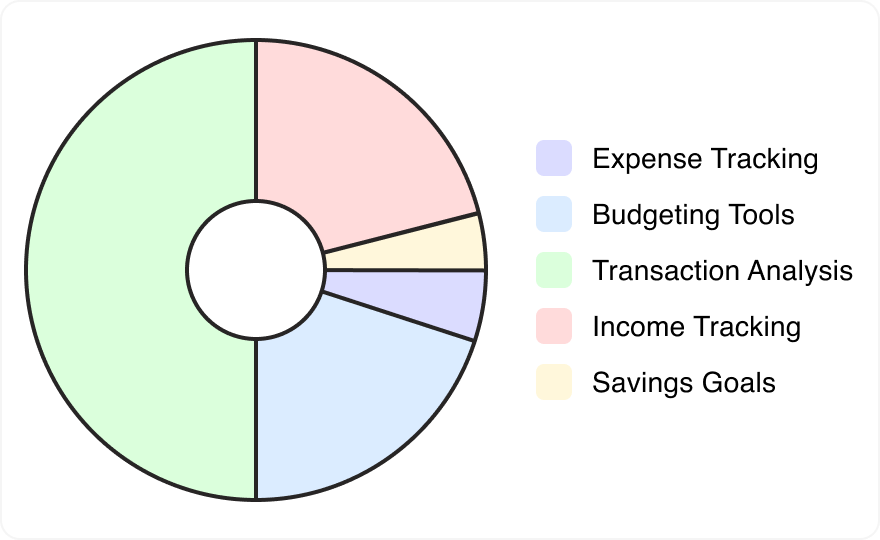

The Personal finance management UI/UX case study revolves around developing a comprehensive financial platform. This platform aims to empower users with robust tools for expense tracking, budget management, transaction analysis, income tracking, savings goals, investment recommendations, and goal-based investing.

Cross Functional Teams

03

Design Team

02

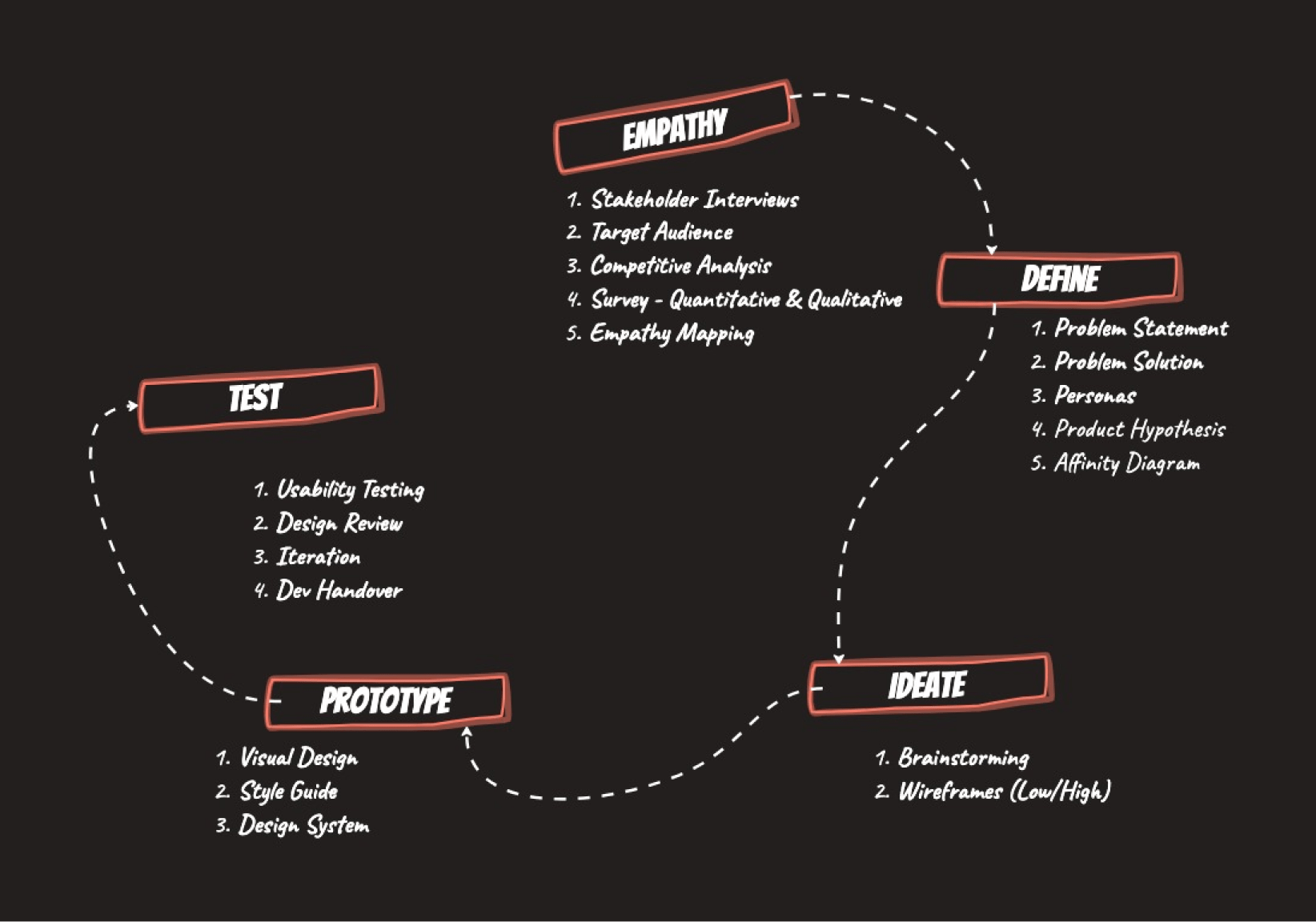

- User Research

- Target Audience

- Survey - Quantitative & Qualitative

- User Interviews

- Competitive Analysis

- Affinity Diagram

- User Personas

- Empathy Mapping

- Product Hypothesis

- Information Architecture

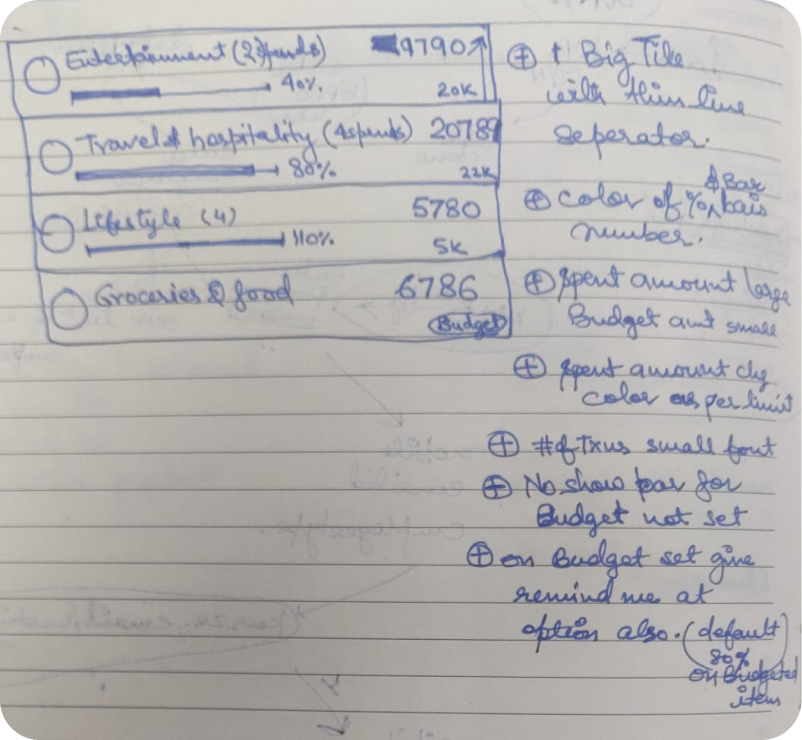

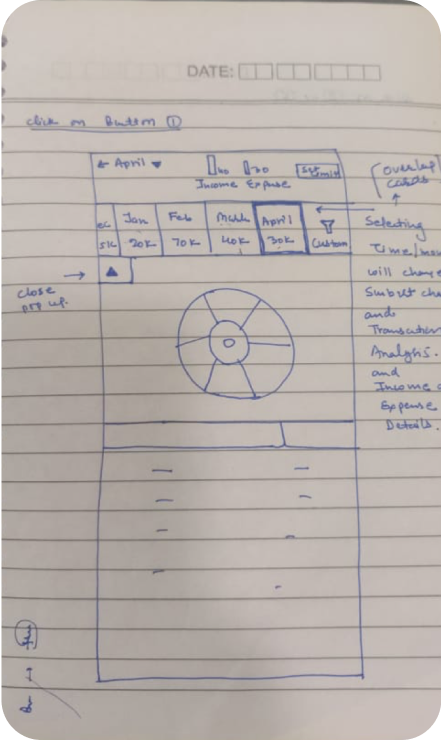

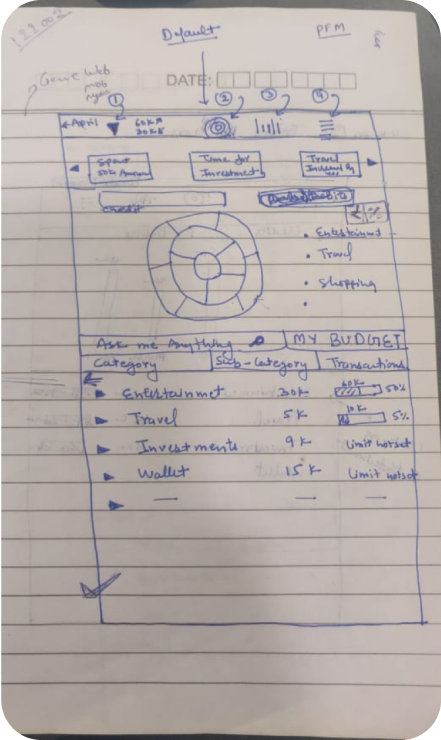

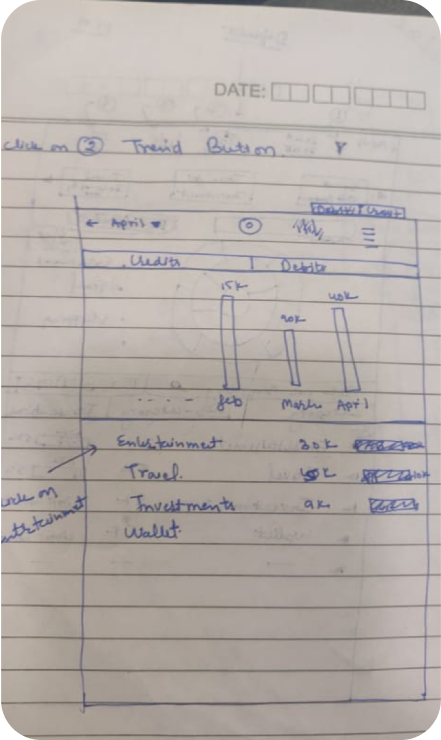

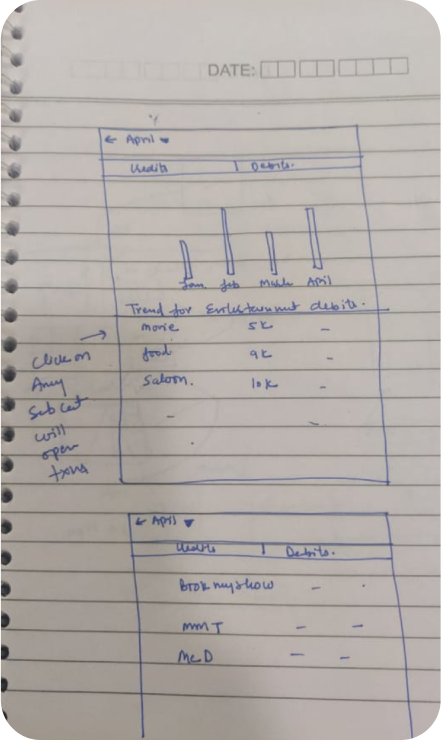

- Wire-framing

- Prototype

- Visual Design

Challenge:

The lack of a centralised and intuitive system hinders users from gaining a comprehensive view of their spending habits.

Challenge:

Users find it challenging to adhere to generic budgets that do not align with their individualised financial goals and lifestyles.

Challenge:

Users miss out on understanding detailed spending patterns, trends, and opportunities for optimising their finances.

Challenge:

Incomplete income tracking results in a lack of clarity about overall financial health and available funds.

Challenge:

Without a clear view of their goals and progress, users may lose motivation and struggle to stay on course.

Challenge:

This uncertainty hampers the ability to grow wealth strategically and in alignment with long-term financial objectives.

Challenge:

This complexity hinders users from making investment decisions that directly contribute to achieving their desired life milestones.

Responsibility:

Taking charge of the design direction and strategy, ensuring a cohesive and visually appealing user interface.

Action:

Guiding the design team in translating stakeholder goals into visually engaging and intuitive design elements.

Responsibility:

Conducting user research to understand the target audience's behaviours, preferences, and pain points.

Action:

Utilizing stakeholder interviews to gather comprehensive requirements, ensuring the design aligns seamlessly with user needs and business goals.

Responsibility:

Adopting a user-centered design philosophy to prioritize the end-user experience.

Action:

Integrating user personas, empathy maps, and feedback from user research into the design process, ensuring the platform addresses real user challenges.

Responsibility:

Designing an intuitive and efficient personal finance management platform.

Action:

Implementing design principles that prioritize ease of use, clear navigation, and an aesthetically pleasing interface, contributing to an enhanced overall user experience.

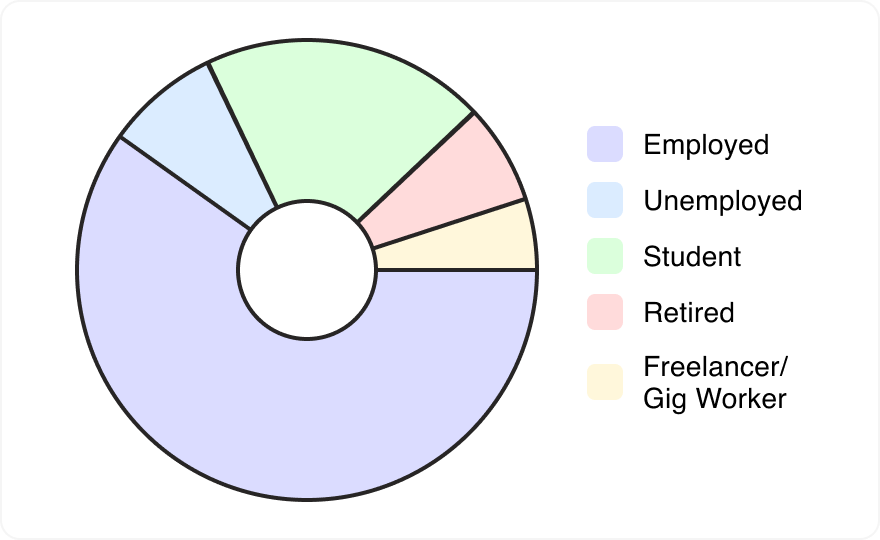

Graduates and early-career professionals who are navigating their first jobs and managing finances independently.

College and university students who are learning to manage their finances for the first time, (tuition, accommodation, etc.)

Individuals who are retired and want to manage their pensions, investments, and savings during their post-working years.

Couples, married or in a committed relationship, who want to jointly manage their finances & shared financial goals.

Users with an interest in investments, stocks, and growing their wealth through strategic financial planning.

Individuals who frequently travel and need a financial management tool that considers expenses related to travel and exploration.

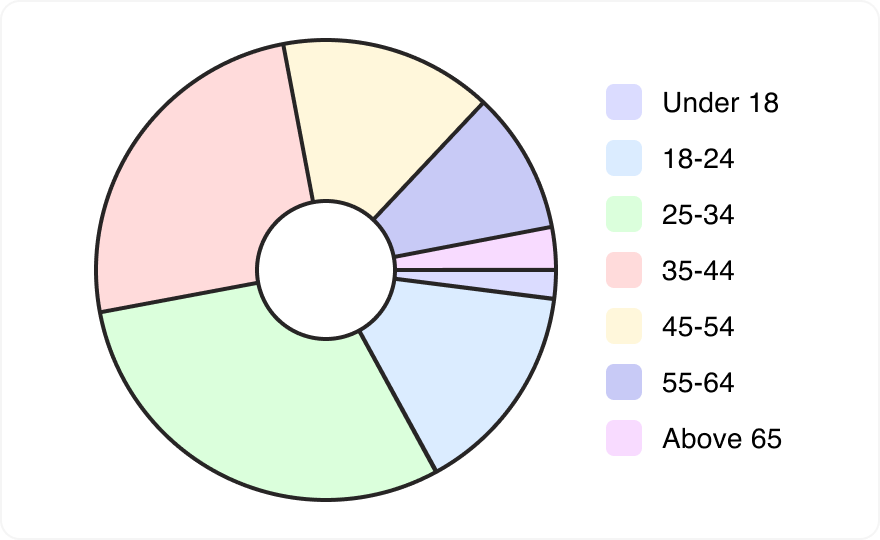

In developing the Personal Finance Management App, we utilize both quantitative and qualitative methods. This combination allows us to gather a comprehensive understanding of our target audience's preferences, behaviours, and experiences. This dual methodology ensures a holistic approach to designing an app that caters to the diverse needs and expectations of our users.

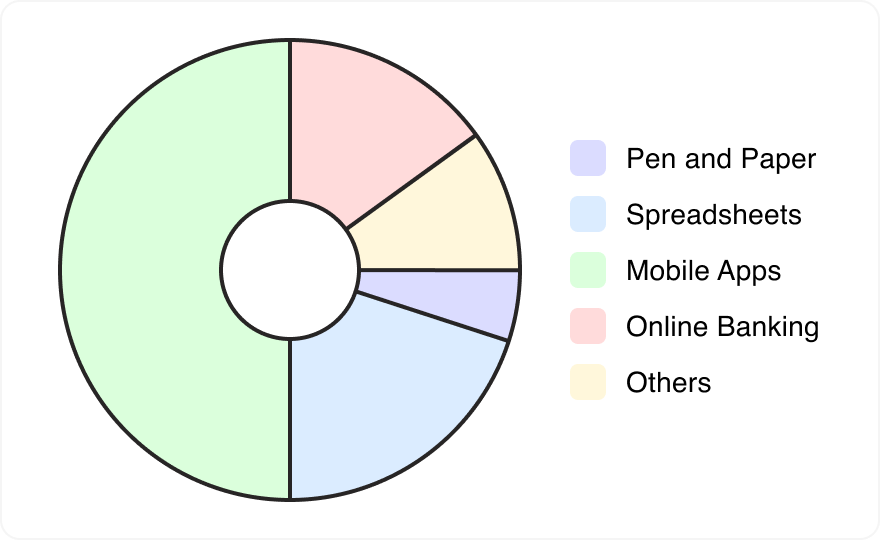

Current Financial Management Methods

Users employ a variety of methods, including mobile banking apps, spreadsheets, and a combination of cash and online tools.

Challenges and Frustrations:

Users commonly face challenges in budgeting, categorization of expenses, and setting clear savings goals.

Investment Confidence:

Users exhibit varying levels of confidence in making investment decisions, expressing a desire for more guidance and educational resources.

Desired App Features:

Common feature requests include automated expense categorization, real-time budget tracking, flexible budgeting tools, detailed transaction analysis, and guided goal-setting.

Notification Preferences:

Users prefer a mix of push notifications on mobile apps and email alerts, depending on the nature of the financial update.

32

Male

Married

Investment Analyst

Gurgaon

18 lac pa

Sanuj, a seasoned investor, navigates the financial landscape with confidence. With a keen eye for market trends and a desire for simplified insights, he values efficiency and accuracy in his investment decisions. In his pursuit of financial success, Sanuj seeks a finance management app that aligns with his active investment approach, providing real-time updates and personalised recommendations.

- Grow wealth through strategic investments.

- Make informed decisions based on accurate financial data.

- Emphasizes on robust investment features.

- Values customizable tools for tracking and analyzing investment portfolios.

- Actively manages investments and follows the stock market.

- Prefers apps that provide detailed investment insights and recommendations.

- Seeks simplified investment recommendations.

- Desires real-time updates on market trends.

28

Female

Married

Project Manager

Gurgaon

21 lac pa

Shreya is a sensitive planner who prioritizes financial organization. She diligently tracks her expenses but struggles with manual categorization and maintaining a detailed budget. Shreya seeks a user-friendly finance app that automates expense tracking, offers adaptable budgeting tools, and aligns with her need for simplicity and effectiveness in managing finances.

- Achieve financial goals through disciplined budgeting.

- Save efficiently for future milestones.

- Prioritizes apps with strong budgeting and expense tracking tools.

- Appreciates features that simplify the categorization of expenses.

- Prefers structured budgeting and expense tracking.

- Values user-friendly interfaces for efficient financial management.

- Struggles with maintaining a detailed and organized budget.

- Seeks tools that automate expense categorization.

32

Male

Married

Investment Analyst

Gurgaon

18 lac pa

Rahul is a tech enthusiast who values modern design and customization in digital tools. He is dissatisfied with the limited customization options and outdated interfaces of existing finance apps. Rahul seeks a finance management app that emphasizes modern interfaces, customization features, and seamless integration with emerging technologies to enhance his financial management experience.

- Leverage technology for efficient financial management.

- Invest strategically and grow wealth over time.

- Values apps with modern interfaces and real-time updates.

- Seeks customization options for personal financial preferences.

- Comfortable with technology and digital solutions.

- Prefers apps that leverage innovation for a seamless user experience.

- Expects apps to adapt to changing financial needs.

- Desires a streamlined approach to savings and investment.

- I need personalised insights to guide my investment decisions.

- An easy-to-use budgeting tool would significantly improve my financial management.

- A modern interface with customisation options is crucial for an ideal finance app.

- Simplified recommendations can save me valuable time and effort.

- Access to real-time financial data is essential for informed decision-making.

- Technology should enhance, not hinder, my financial management experience.

- Actively manage portfolios and seek investment insights.

- Regularly review budgets and track expenses meticulously.

- Explore new apps and digital tools for a seamless financial experience.

- Confidence when financial goals are achieved.

- Satisfaction when financial tools are efficient and intuitive.

- Excitement when using tech-savvy solutions.

- I need personalised insights to guide my investment decisions.

- An easy-to-use budgeting tool would significantly improve my financial management.

- A modern interface with customisation options is crucial for an ideal finance app.

- Simplified recommendations can save me valuable time and effort.

- Access to real-time financial data is essential for informed decision-making.

- Technology should enhance, not hinder, my financial management experience.

- Actively manage portfolios and seek investment insights.

- Regularly review budgets and track expenses meticulously.

- Explore new apps and digital tools for a seamless financial experience.

- Confidence when financial goals are achieved.

- Satisfaction when financial tools are efficient and intuitive.

- Excitement when using tech-savvy solutions.

In order to attain a more thorough grasp of challenges, user needs, and goals, we intricately constructed an affinity map. This visual depiction enables us to recognize patterns, pinpoint essential insights, and attain a more lucid perspective on the intricate terrain of user experiences and aspirations.

- Effectively utilizing savings in times of unexpected challenges.

- Overlooking payments for monthly recurring expenses.

- Insufficient financial management and difficulty in minimizing costs.

- Dealing with sudden and unforeseen expenses.

- Struggling to achieve financial goals.

- Operating without a structured financial plan.

- The ability to forecast and manage expenses.

- Strategies for minimizing non-essential expenditures.

- Reminders for timely payments of expenses on specific dates.

- Systems for categorizing and organizing expenses.

- Techniques to stay within budget during crisis situations.

- Enhanced awareness of expenses and income.

- The provision of savings to navigate through crisis times.

- Timely reminders for expense payments.

- Goal-setting features with continuous progress awareness, fostering motivation.

I developed a Product Hypothesis to pinpoint potential directions and features that align with the user needs uncovered during our research. This hypothesis acts as a guide, translating insights gathered from user research, stakeholder interviews, and competitive analysis into a roadmap. It helps us shape the design and development process, ensuring that the final product effectively addresses the challenges and goals identified during the research phase.

Users like Savvy Investor Sarah face difficulties accessing simplified investment insights and real-time market updates with existing finance apps.

Creating a finance app with detailed insights, simplified recommendations, personalised dashboard for comprehensive investment tracking and real-time updates addresses challenges for users like Sarah.

Implementing detailed investment features and real-time updates is expected to boost user engagement, satisfying active investors like Sarah.

Users like Savvy Investor Sarah face difficulties accessing simplified investment insights and real-time market updates with existing finance apps.

Creating a finance app with detailed insights, simplified recommendations, personalised dashboard for comprehensive investment tracking and real-time updates addresses challenges for users like Sarah.

Implementing detailed investment features and real-time updates is expected to boost user engagement, satisfying active investors like Sarah.

Users like Savvy Investor Sarah face difficulties accessing simplified investment insights and real-time market updates with existing finance apps.

Creating a finance app with detailed insights, simplified recommendations, personalised dashboard for comprehensive investment tracking and real-time updates addresses challenges for users like Sarah.

Implementing detailed investment features and real-time updates is expected to boost user engagement, satisfying active investors like Sarah.